When Money Grows On Trees: Using Covered Calls To Generate Income

For most individuals that are starting their journey into the equities market, they either begin with purchasing shares of a company, index fund, ETF, or a mixture – then proceed to hold onto these share for the long term, and dollar cost average into their position while they (hopefully) appreciate in value. However, during the past decade something miraculous changed: the introduction of commission free trading due to popular brokerage apps such as Robinhood effectively revolutionizing how the equities markets operate, especially for the retail investor. Then came the introduction of options trading in December 2017 on the Robinhood platform, opening doors that would allow anyone with an account to leverage themselves as much as could tolerate.

Retail investors on the Robinhood platform could now either open a call position, if they are bullish, or puts, if they are bearish, based on their thesis. And for most individuals that are using any brokerage service, their education about options tend to stop here – aside from maybe learning about the Greeks, which are used to determine the price of any options contract. But what happens when instead of buying these contracts, you are on the opposite side of the trade and actually sold them instead? Due to its simplistic nature, the covered call strategy is usually one of the first options strategies recommended for beginners, and when used correctly could help you generate extra monthly income.

What are covered calls?

Before diving into what covered calls are, let’s first take a step back and give ourselves a quick reminder about what a call option is. A call option is a bullish position where you are purchasing a call contract for the right to purchase 100 shares of the underlying stock, as long as the underlying stock either reaches, or surpasses your strike price at or before expiration. This position has theoretically unlimited profit potential with the risk of losing all the money you spent to buy this contract, also called the premium. On the other side of this trade, if you are the seller of the call option contract, you are selling the right to give the buyer the opportunity to purchase your 100 shares of the underlying as long as the underlying stock hits or surpasses the strike price at or before expiration. By doing this, you are agreeing to limit your upside potential with the shares you own in exchange for the premium paid by the call option buyer. If these requirements don’t happen, the call options seller keeps both their 100 shares and premium collected from selling the contract.

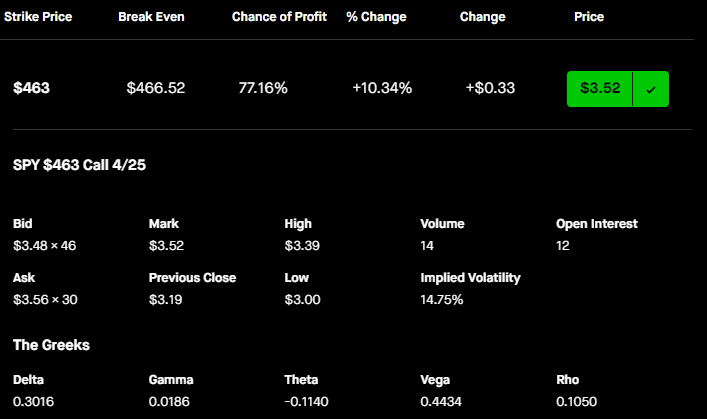

Now let’s illustrate what I’m talking about by using some real examples with $SPY from the Robinhood platform. As of cash close on Friday, March 25, 2022, $SPY closed at $452.69.

I chose the $463 strike price because its delta is at 30 and the April 25 expiration date since it is a month out, giving us 30 days until expiration.

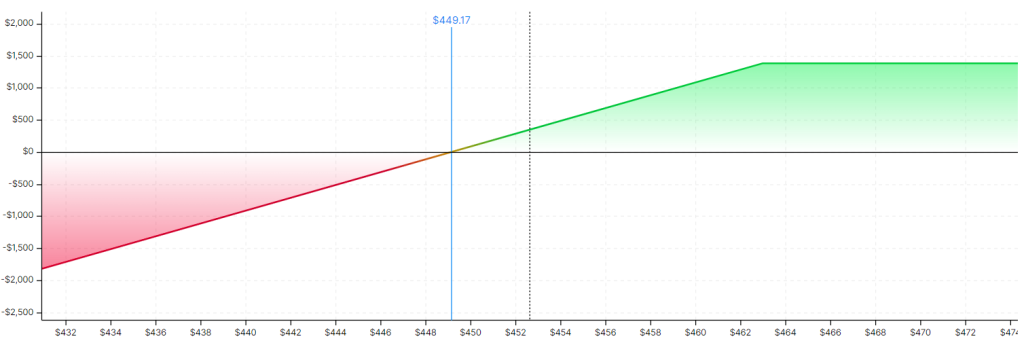

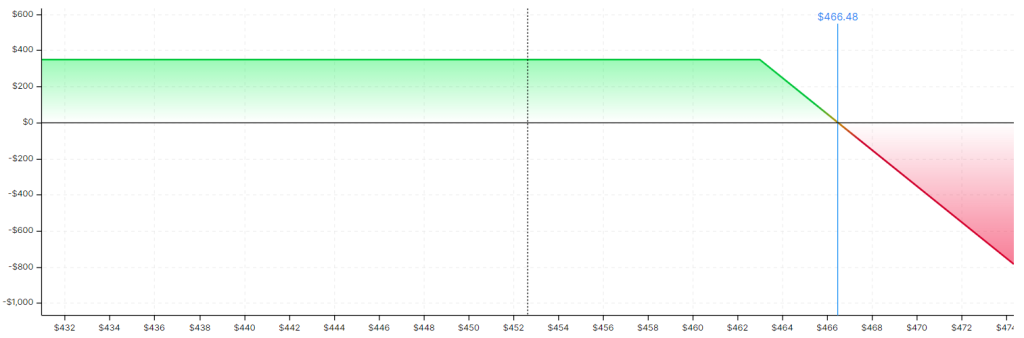

If you were to purchase this contract, you would need to pay $352 in premium due to the options multiplier ($3.52 * 100 = $352). Your max loss is the amount of money you paid for this contract, which is $352, and your profit potential is theoretically unlimited. Even if $SPY hits $463 at the time of expiration and you get the right to purchase 100 shares of $SPY, you still need $SPY to reach $466.52 in order to break even at expiration (as shown with the graph above).

On the other side of that trade you have the seller that is collecting premium. But since we are talking about a covered call strategy here, the seller would also need to purchase 100 shares of $SPY ($452.69 * 100 = $45,269) in order to protect themselves. Selling this call option contract would net the seller $352, reducing the cost basis for this strategy to $44,917. The max potential loss for this would be the full $44,917 while the max potential profit would be ($352 + (($463 – $452.69) * 100)) $1,383. While the idea of losing $44,917 is mind boggling, the chance of that happening is near zero unless it’s the world is ending. Also notice here that the break even point is at $449.17 since the seller collected the $3.52 in premium ($452.69 – $3.52 = $449.17). Collecting premium reduces the sellers cost basis.

What happens if I don’t own the shares and the contract gets exercised/ shares are called?

What makes this a covered call strategy is that you are covering yourself because you actually own 100 shares of the underlying stock in order to protect yourself while selling a call. If you do not own the 100 shares of the underlying you are participating in something called a naked call, also known as a short call, where you are selling the contract without owning any of the shares you are promising to sell to the buyer. Using the same example as before, your max profit is $352 while your potential loss is theoretically infinite. As the saying goes, you’re “picking up pennies in front of a steam roller.”

If $SPY were to hit the strike price of $463 and the contract was exercised, as the call seller you are now obligated to sell the call buyer 100 shares of $SPY at $463. So if you did not own the said 100 shares of $SPY already, that means you would need to spend $46,300 to purchase the shares so you can sell them back to the call buyer. The worse case would be when $SPY goes beyond that $463 strike price. For example, if $SPY hit $475, you would need to purchase 100 shares of $SPY at $475 and then are still obligated to sell those same 100 shares to the call buyer at $463. This would be a loss of $1,200.

Why would I use covered calls?

The covered called strategy is multi-purpose depending on how you decide to use it.

In the scenario depicted above within the “What are covered calls?” section, you would use the covered call strategy to initiate a position you plan on holding for a short period of time with the intention to trade. Ideally, the call you sold would either be at the money or in the money by the time the contract expires, allowing you to sell the shares for the agreed upon price as well as keeping the premium. The ability to collect premium allows you to both: have downside protection by reducing your cost basis if the stock drops in value and allows you to squeeze more money if the underlying appreciates to or above the strike price. You would not care about how high the underlying stock appreciates in value because your covered call position is complete.

Another scenario you would use covered calls for is when you want to begin devesting your positions. Say you bought 100 $SPY shares back when it was $300 and now you feel comfortable enough to sell at $452.69; that is a gain of 50.9%. Instead of selling your shares, you could instead sell calls to squeeze additional money from your position. If the underlying doesn’t hit your strike price, you get to do this over again until the contracts get exercised. So instead of that 50.9% gain, your returns would actually be much more. If this is your intention and you want to ensure that your shares get called, you would gravitate towards higher delta options.

A third scenario would be if you wanted to reduce the cost basis on your position with the intention of holding for the long term. For example, if you wanted to hold $SPY shares for the long term and you purchased them at it’s current price of $452.69, you could sell the 30 delta monthly call on a monthly basis for $3.52. If you successfully did this for a year and managed to collect premium without the shares being called, (12 * $3.52 = $42.24) you would have reduced your cost per share from $452.69 to $410.45.

It’s also interesting to note that the Chicago Board Options Exchange (CBOE) created an index (BXMD) to track the performance of a hypothetical covered call strategy that holds long term $SPY positions that sell monthly out of the money call options with strikes nearest to the 30 delta. The results show that this strategy consistently outperforms the S&P 500.

To sum up this section:

- Initiate a short term trade position with the intention to unload your shares while adding downside protection from collecting premiums

- Devest holdings

- Reduce cost basis for long term holds

- Outperforms the S&P 500

So how do I actually generate income using covered calls?

In order to generate income using covered calls, you first need to own 100 shares of any security, either that be from a public company, index fund, or ETF. You would sell the monthly (as close to 30 days) call in order to take advantage of the exponential rate of decay due to theta.

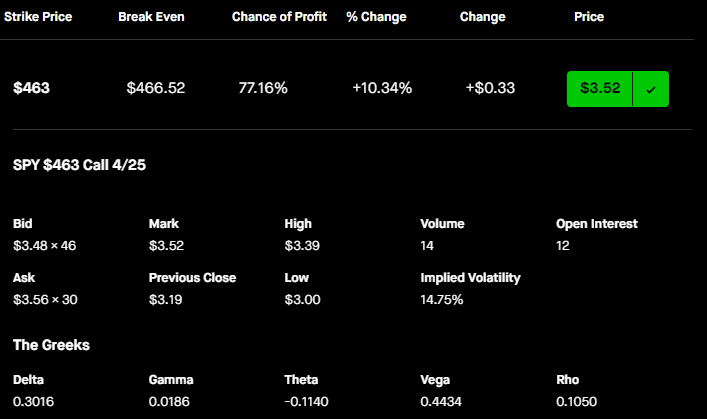

Assuming that you don’t actually want your shares to get called, you would want to focus a bit more on the chance of profit from selling these contracts instead. Now, depending on your own risk tolerance, this is were you would decide on the contract you are selling based on the delta. Using the example from earlier:

The $463c April 25 call cost $3.52 with a 77.16% chance of profit. If you were to lower your delta by 10 and sell the 20 delta instead:

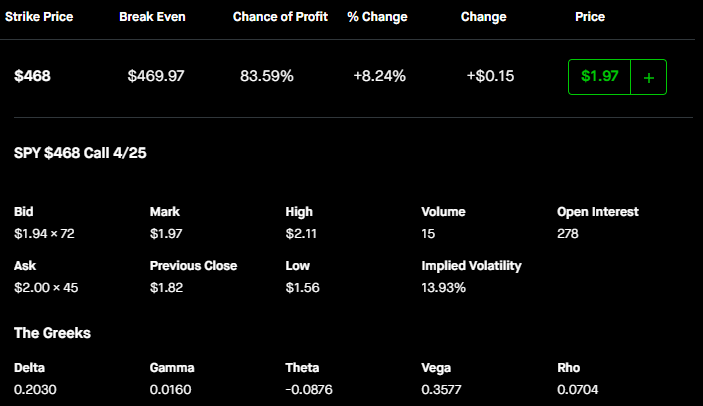

You would be looking at a 5% increase in the chance of profit in exchange for ($3.52 – $1.97) $1.55 in premium. If that 5% assurance to you is worth the $155 you lose from 10 delta, then you should sell the 20 delta, if not, the 30 delta. It really depends on your own risk tolerance.

Another important thing to consider when selling calls is what the implied volatility (IV) is. Understanding the historic IV as well as the current IV would allow you to maximize the premiums you collect.

Alternatively, if you don’t have enough money for this strategy you can employ a poor mans covered call. Instead of owning 100 shares, you can instead purchase a deep in the money call that is far dated, and sell a shorter dated out of the money call. This strategy is more risky and complex so not advised for beginners.

Quick pointers on covered calls

Depending on what you plan on doing with covered calls, the delta you are selling matters. Higher the delta, the higher the likelihood of the underlying being at or in the money. Further the delta, the lower likelihood of the underlying being at or in the money.

When it comes to the expiration date, go with call options that expire within the month. This is because the extrinsic value of the contracts decays at a exponential rate, especially when it comes to theta (#thetagang).

Comments are closed.