Imagine this: you just earned your drivers licenses after passing both DMV test and decide to purchase a car to celebrate your accomplishment. But before you are allowed get on the road, you need to buy some car insurance first (as required by most states). The insurance premium that you pay for protection is meant to be reassurance to you that if something were to happen while you were driving your vehicle, you would get some type of financial reimbursement for the incident. Of course you never actually want any type of scenario to happen to you or your car; but in case something ever does happen, having bought that car insurance gives you a sense of safety knowing that you are covered.

But now what if you’re on the other side of this transaction and instead of being the driver buying insurance, you are the salesman selling it. You need to determine what the risk is going to be like to insure this new driver, what car type and make they are driving, along with a multitude of other factors that will be used to figure out the premium and their own preferences for deductibles.

This is essentially what you are doing with cash secured puts. You are selling insurance to the put buyer according to the risk that is associated with the contract such as the Greeks, implied volatility, and chance of profit/ likelihood of being in the money. By doing so, you are giving them the reassurance that if the underlying stock falls to or below the strike price of the contract, you will buy their shares no matter how low the stock is at expiration, even if it reaches $0. In return for this reassurance, you collect the premium from selling puts to the buyer.

By using cash secured puts intelligently, consistently, and effectively, you will be able to generate extra monthly income for yourself on a yearly, monthly, weekly, or daily basis depending on your personal time frame.

What are cash secured puts?

Cash secured puts is a options strategy where you are selling puts in order to collect premium from the buyer of the contract. This is similar to the covered call strategy, where you are required to own 100 shares per contract you decide to sell so you are able to collect premium from the buyer.

The main difference between these two strategies is that you don’t own any shares of the underlying stock when you use cash secured puts. Instead, you need to have enough capital to put up for collateral in order to have the ability to purchase 100 shares per contract you sell if the put contracts were to ever be at the money or in the money during expiration. Remember, a put option contract gives the buyer the ability to sell 100 shares of the underlying stock to the put seller as long as the contract when conditions are met. This is why as a put seller, you need to have enough collateral to purchase those shares at the agreed upon price if the underlying is in the money by expiration.

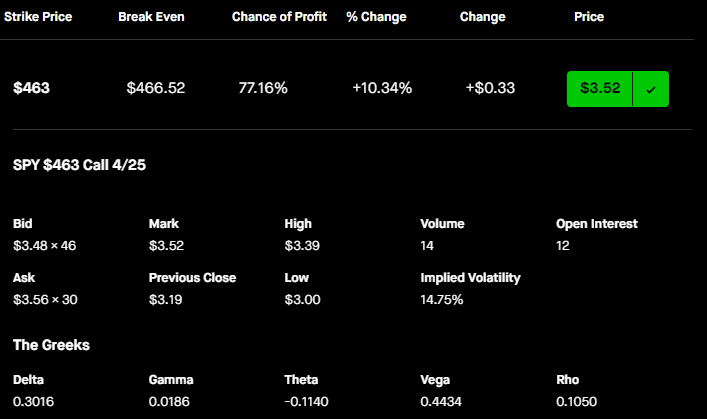

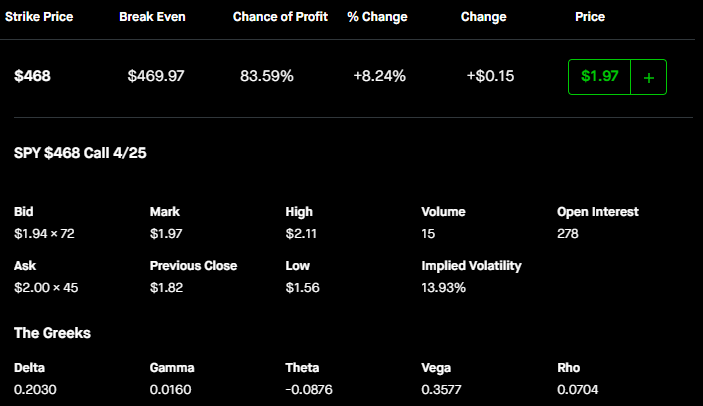

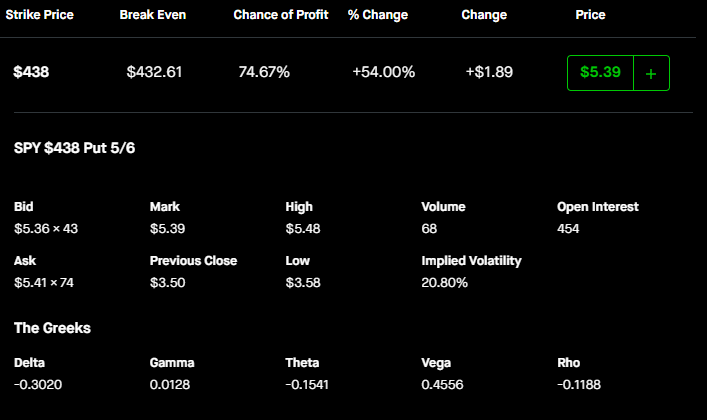

Let’s dive into some examples to illustrate what I am talking about here using the Robinhood platform due to its friendly UI/UX. As of cash close on Monday, April 5, 2022, $SPY (S&P 500 ETF) closed at $451.03.

The reason why I chose this $442 strike expiring May 6 is because of its negative 30 delta that is expiring a month out (30 days). A 30 delta roughly means that there is a 30% of the contract being in the money at expiration.

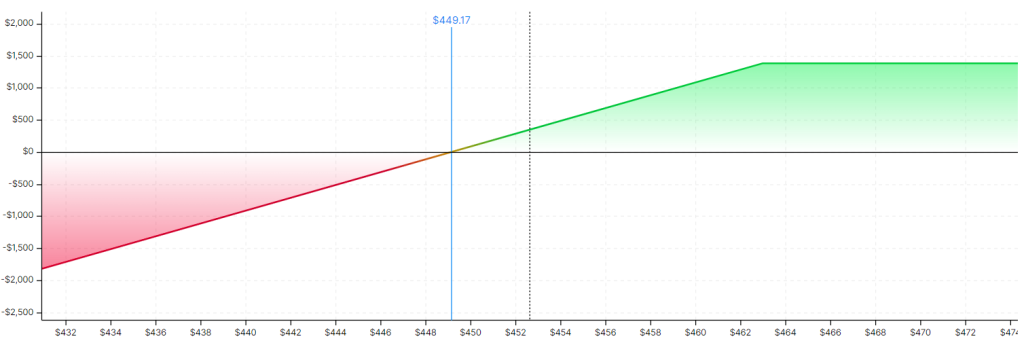

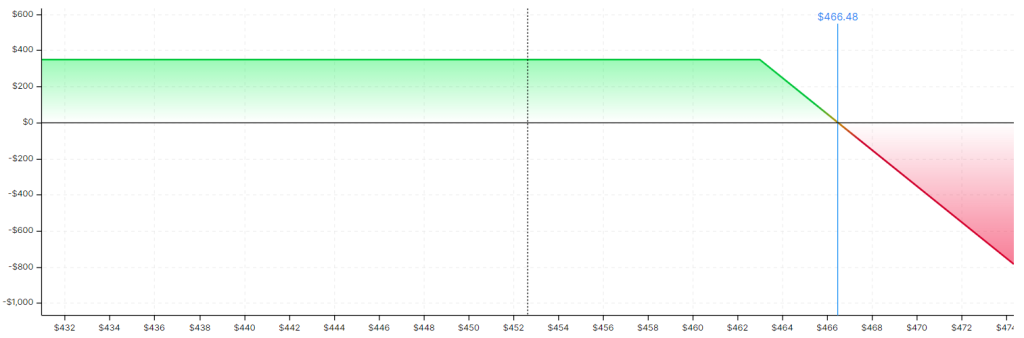

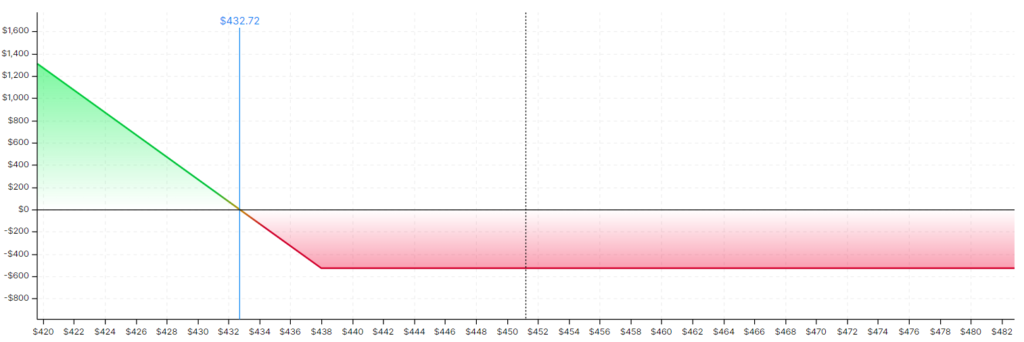

Say you sold this contract, you would be collecting $539 ($5.39 * 100 due to options multiplier) in premium from the buyer. Your max loss for this trade is theoretically $43,261 if $SPY were to ever go straight to $0 (not likely to happen due to the nature of $SPY). Because you sold this contract, and assuming you don’t buy it back, you would need to purchase 100 shares per contract sold at the strike price of $438. Since you also collected the premium from the buyer for the contract you sold, you knock down your price price of $43,800 by $539 to $43,261. Therefore, your max profit for this trade is $539.

Notice how this strategy is different compared to a long put where the strategy involves you purchasing puts instead of selling them.

Theoretically for this trade, as the put buyer, you are paying $539 for this contract for the ability to make $43,261 if $SPY were to go to zero. Remember that as a buyer, the options tend to be over priced and is against you. The chance of this going to going in the money is about 30% while the chance of the options seller profiting the entire $539 is 75%.

Let’s use a different example where the underlying stock is in the double digits instead of the triple digits. As of cash close on Tuesday, April 5, 2022, $FCX (Freeport-McMoRan Inc) closed at $49.09.

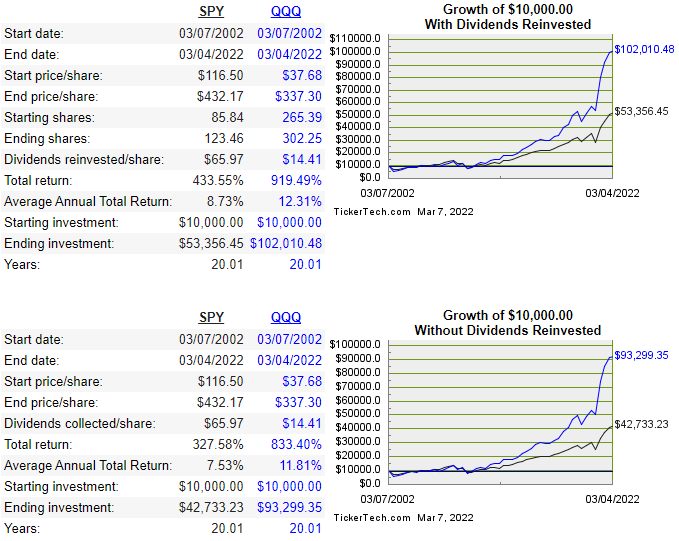

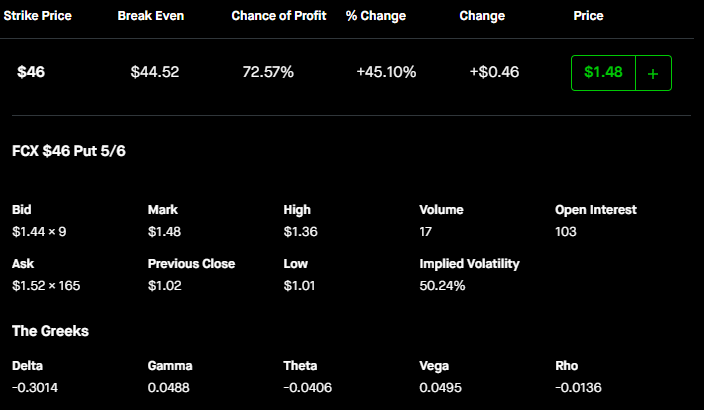

One month out (30 days) $46p May 6 cost $148. To sell this one you would need to put up $4,600 for collateral. Doing this for one month successfully would increase your position by 3.2% ($148/$4,600) which means doing this for one year would increase your position percentage by 38.4%, almost three times higher than the average growth of the $SPY. Or, in other words, an extra $148 in income per month.

Note: Some numbers on Robinhood and OptionStrat are a bit different. I decided to stick with the numbers from Robinhood for consistency and left OptionStart graphs to visualize what the P/L would roughly look like.

Why would I use cash secured puts?

As demonstrated in the previous example with $FCX, using cash secured puts consistently and successfully on a monthly basis (or whatever time frame you’re working with) can either help you generate extra income or even outperform the market. But that’s not all cash secured puts can help you do.

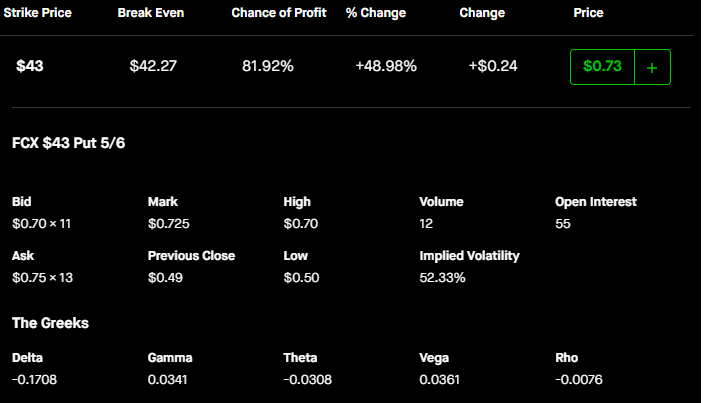

Say you actually are looking at $FCX and from the thesis you have built you would like to have some exposure in this company. However, you think that the current price is overvalued and would prefer to have a lower entry. You have concluded that a reasonable price to enter this stock due to it’s one year trading range is at a high of $43 and low at $36. Looking at the $43 strike price with all else being equal:

we can see that this contract cost $73 each. If they go up in value before you are able to open a position for exposure, that’s fine because you were able to make a gain. If you still wanted to open a position because you strongly believe in your thesis, then just adjust the contract accordingly. Of course if you were a bit impatient you can move the contract you decide to sell closer to the money so you are able to collect higher premium along with a higher chance of being assigned the shares, ultimately reducing your cost basis.

Another way you would implement this options strategy is when you expect the underlying stock you are holding in your long term portfolio to go down and would like to both reduce your average cost and increase your exposure. You would sell puts on the underlying so you are able to reduce your cost basis and increase your holdings. This is great because timing the market is incredibly difficult to do and it is much more simple to have these contracts out and execute for you. If you happen to be wrong with your duration that’s fine because you got to collect premium and can do it all over again.

So how do I actually generate income using cash secured puts?

Depending on which ticker you are looking at, you would need to calculate how much it would cost you to buy 100 shares of the underlying stock so you know how much you need to put up for collateral. So if you were to have sold the $SPY $400p, you would need to have $400*100= $40,000 in your brokerage account to put up for collateral. If you sold the $FCX $40p, you would need to have $40*$100=$4,000 in your brokerage account for collateral; so on and so forth.

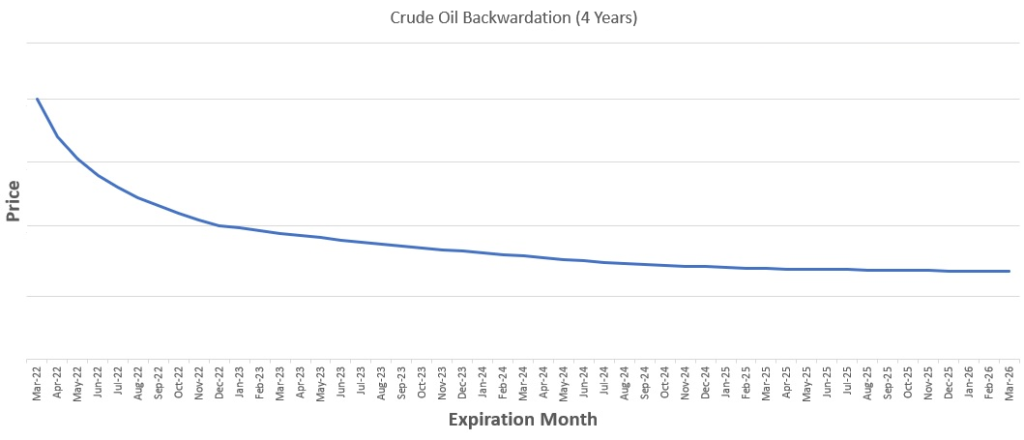

To execute this type of trade, you would want to look for contracts that are about 30 delta with 30 days from expiration. A 30 delta roughly means that the contract being sold has a 30% chance of being in the money by the time of expiration while selling the 30 day out contract allows you to take advantage of the exponentially decay of extrinsic value from these contracts. If your risk tolerance is higher then sell a higher delta, if lower tolerance than sell a lower delta.

You would also want to be aware of what the historic IV is for the ticker you are looking at and what the IV is currently at. Because you are selling contracts, you would want to capitalize on high IV so you are able to collect higher premiums. To find out what these numbers are, you can use resources such as Market Chameleon to help you. Another trick is to make sure that you have done your research on the underlying. Things like earnings, catalyst, trading ranges, and if the stock is trading at historical highs will all have an impact on the outcomes and pricing of your contracts.

Summary of cash secured puts

Cash secured puts is a short put options strategy that can help you outperform the market, generate extra income, or reduce your cost basis. As a put seller, you are essentially selling insurance to the put buyer. In exchange for premium, you are agreeing that you will purchase the underlying stock no matter how low the price of the shares fall to.

When you decide that you want to start using this strategy, consider the following:

- Take into consideration what the historical IV is and where it is currently.

- Do research on the company and look for catalyst.

- Take note of ER dates

- Understand what range the stock is trading.

- Pick tickers where you do not mind holding for a lot time in the scenario where you end up getting assigned.

- Sell contracts according to the delta (depending on your own risk tolerance) which are about one month out (30 days) in order to take advantage of exponential extrinsic decay.