The Savings Account Is Obsolete

There, I said what most people are thinking. The interest rate that you get for storing your hard earned cash into a savings account yields less than a tenth of a percent on average. Some of the biggest banks give a laughable 0.01%, such as Wells Fargo’s Way2Save, Bank of America Advantage Savings, and Chase Savings. The national average on the other hand is about 0.06% according to the Federal Deposit Insurance Corporation (FDIC). This, however, was not always the case.

But don’t get me wrong, there is still a strong need and even necessity to keep money in your bank account; whether that is in your checking or savings, or both, having liquidity will always be important. The real question, even concern at this point is how much money you decide to have in those accounts before you start doing anything else with your excess cash.

Decline of the APY

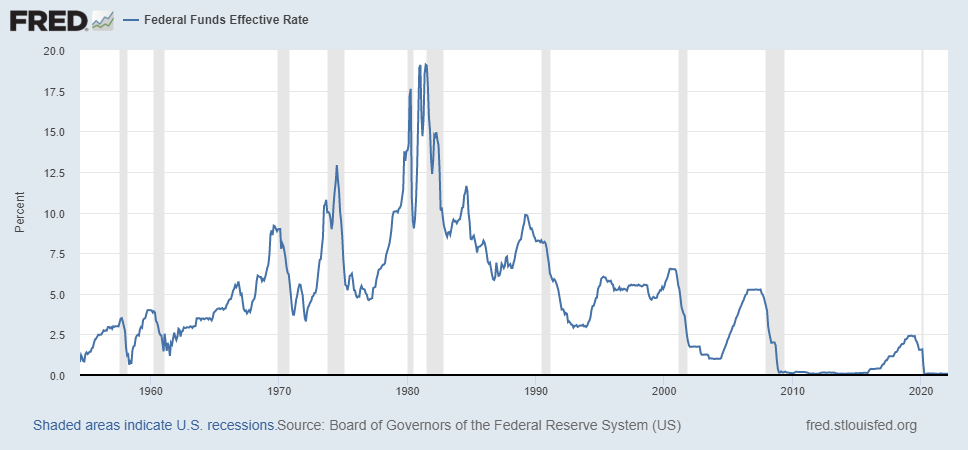

Believe it or not, saving account APY weren’t always this low. In fact, during the 1980s when the fed funds rate were at a record high of near 20%, the saving account APY were in the teens with some accounts claiming to be as high as 20% (corresponding to the fed rate). These numbers are completely unfathomable if you were to explain it to Generation Z and Generation Alpha. So the question remains: what happened to the interest rate for savings accounts?

To answer that question we actually need to take a step back before the 1980s and into the Carter Administration. For decades, the U.S. was struggling in its fight against stagflation, which is a combination of both high inflation and high unemployment; two things the Fed is responsible for due to their duel mandate. When President Carter was sworn into office, one of his first acts as president was to deal with the lingering issue once and for all. In a meeting with the regional fed presidents to determine the next Federal Reverse chairman, Carter met with a relatively unknown individual at the time named Paul Volcker. Volcker was only able to speak with Carter for about ten minutes, but within those ten minutes, he was able to explain his strategy to end stagflation. And when the time came, Carters nomination to become the next Federal Reverse Chair was Volcker himself. Volcker’s plan? To dramatically raise interest rates which resulted in the reduction of the supply of money, and ultimately causing a recession for the U.S. economy. This sudden increase in rates became known as the “Volcker Shock.” Unfortunately for President Carter, it is said that the Fed Chair has more power to determine the outcome of a presidential election based on their monetary policy, and considering how President Carter was a one term president, this theory holds up despite Carters actions.

Obviously the Fed Funds Rate didn’t stay at these double digit levels. Gradually over time in order to improve the economy and to encourage borrowing and spending, the rates slowly declined. Along with it was the APY for saving accounts. The Federal Deposit Insurance Corporation (FDIC) has historic savings rates that goes back to May 2009. It shows that since 2010, savings account interest rates has been on a decline where APY was at 0.19%. Since 2013, the APY for savings accounts has been sitting at 0.06% on average.

For the past two decades, the U.S. has enjoyed a low interest rate environment. The ability to borrow cheap money comes at the cost of low interest rates for their savings, and also checking’s account (which is a lower percentage than the savings rate). The cutting of rates, or in a more recent case, keeping them low, is a way to help boost the economy. Now the question is: is the trade off worth it? My answer: yes, definitely. Though it is nice to earn interest from banks by allowing them to hold your money, there are other, better ways to accumulate interest.

Store of Wealth

If the reason why you decide to store all of your wealth in your bank accounts is due to safety, I can understand that. But there are also other alternatives with the same amount of safety, if not more secure. These alternatives also offer a higher interest rate than the ones you would get from banks. I’m of course talking about government bonds. Government bonds, in this case U.S. Bonds, are low risk investments which are backed by the U.S. government. These investment securities are purchased through the U.S. Department of Treasury and earn interest over time until their date of maturity. Nowadays, you’re able to purchase these through the U.S. Treasury Department online through TreasuryDirect.

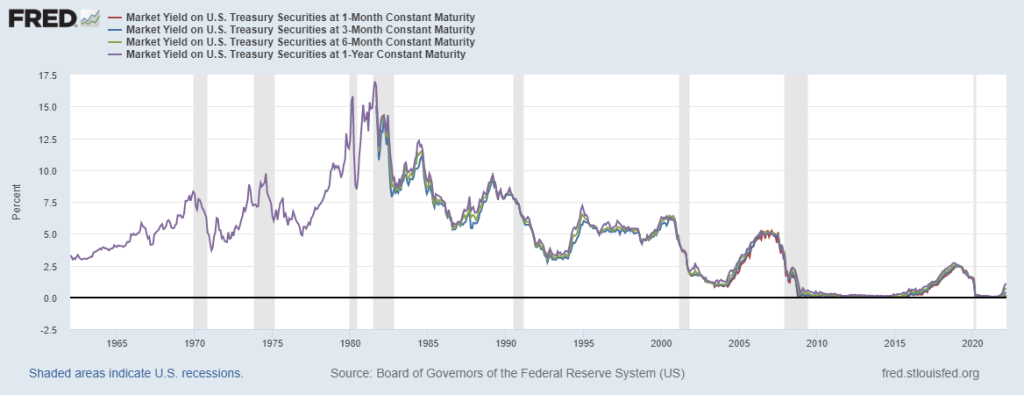

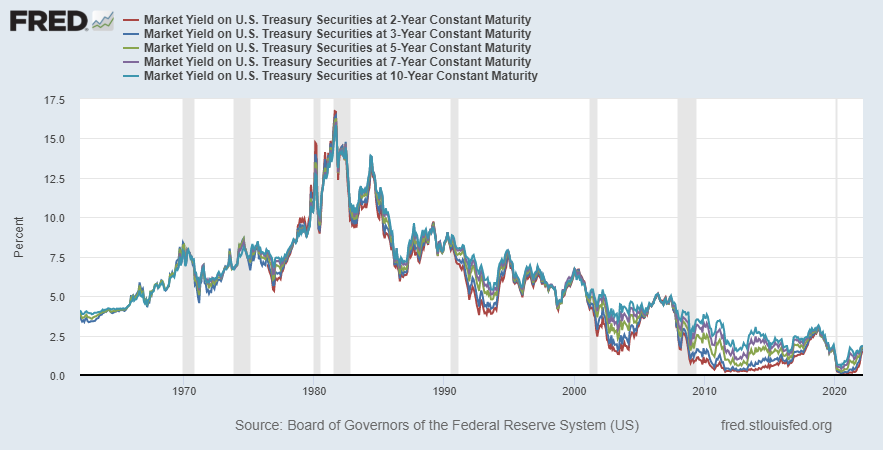

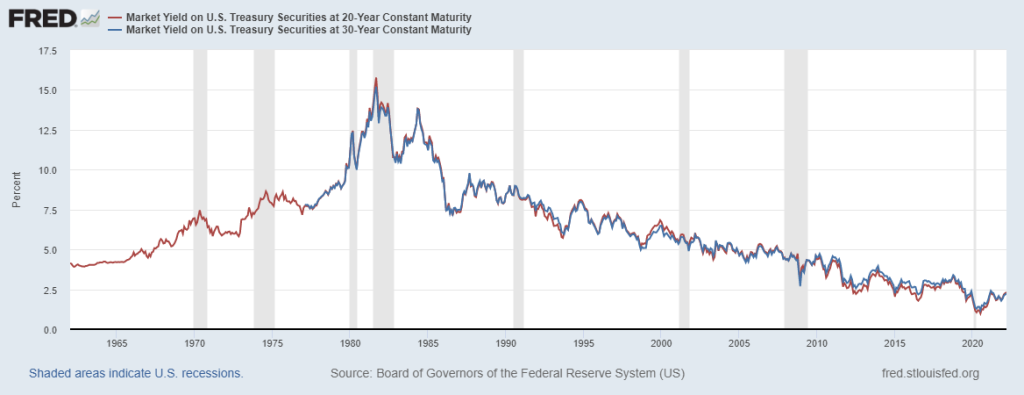

The U.S. government offers three different types of treasuries: treasury bills (T-bills) with maturity date up to one year, treasury notes (T-notes) with maturity between 2 to 10 years, and treasury bonds (T-bonds) with maturity of over 10 years. As of writing this post (March 2022), the rates on these treasuries are:

- 1 Month: 0.19%

- 3 Month: 0.38%

- 6 Month: 0.69%

- 1 Year: 1.08%

- 2 Year: 1.53%

- 3 Year: 1.69%

- 5 Year: 1.74%

- 7 Year: 1.82%

- 10 Year: 1.86%

- 20 Year: 2.32%

- 30 Year: 2.24%

Though it wasn’t necessary to show all of these treasuries, I wanted to emphasize that there is a variety to pick from. But lets just take a second and look back at the shortest maturity treasury out there: the 1 month T-bill with a 0.19% interest rate. That’s already 19x the amount saving accounts from big banks give you in interest, or about 3x as much from the average! Let that sink in for a second.

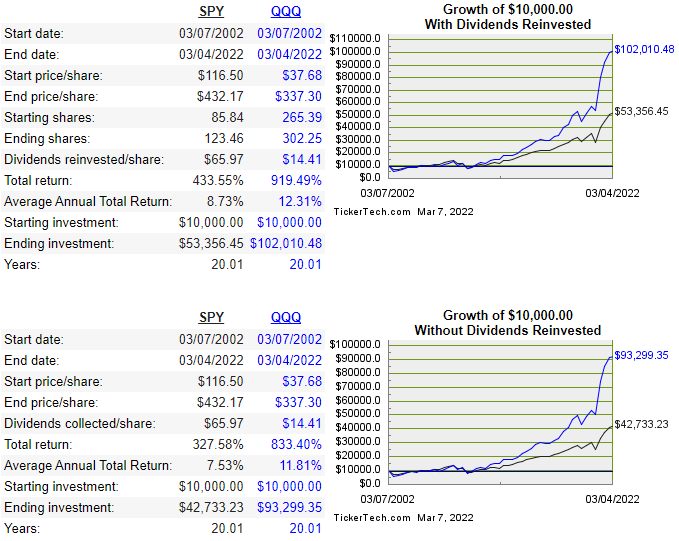

If your appetite to increase your wealth has grown but are still a bit worried about your losing your money, you could stick with index funds such as the $SPY or the $QQQ. These two essentially track the largest 500 and 100 companies trading on the stock market, respectively. Therefore, because they are essentially a diversified fund, the likelihood of losing a large chunk of money is low. But it should be noted that past performance does not indicate future returns.

If you were to invest $10,000 20 years ago into one of these two funds, your portfolio would currently be worth $93.3k ($QQQ) or $42.7k ($SPY). Since these two do give out dividends, if you were to have reinvested all of that income back into acquiring more shares, you would have $102k ($QQQ) or $53.3k ($SPY). How much do you think you would have if you let that $10k sit in your bank account for 20 years? Now also consider inflation being on average 2-3% annually; in terms of purchasing power, that $10k would be worth a lot less than how much you put in.

Importance of Liquidity

Despite all of this, I still believe that the savings account has a place in our lives. We need a place to store our money, and it would be irrational to have our savings in cash hiding under our mattress. The only real viable place is to deposit that into your bank account. If all of your net worth is purely in assets, the problem comes when you need the cash for something unexpected, such as medical expenses or a totaled car. If you liquidate those assets for cash, there’s still a procedure that goes with it. You sell the assets, say stocks, you can’t just withdraw the money straight away; the brokerage you signed up for won’t let you do that. You need to let the money settle for a few days before given the ability to do so. Financial experts advise that you should at least have somewhere between three to six months worth of income in savings. But perhaps nothing over that limit. In order to really build your personal wealth, look towards other assets, such as treasuries’ if your tolerance is low or stocks if your tolerance is a bit higher. Though it’s not really seen as a method of increasing your net worth anymore, the savings account acts as the emergency fund you can rely on when you need it most. Plus, it is nice to get that tiny amount of extra money added into our accounts every once in awhile.

I think this is among the most important information for me. And i am glad reading your article. But want to remark on few general things, The website style is great, the articles is really nice : D. Good job, cheers

Comments are closed.